Do 100% of donations really go to nonprofits?

We’ve all heard it: “100% of your donation goes to the charity.” While this statement is proudly made and well intended, it hides the real costs and complexity of getting money to nonprofits — especially when it comes to corporate giving. This myth doesn’t help nonprofits, donors or companies.

How do global giving programs work?

Companies and their people want to give to causes around the world, and there are many ways to go about this. Some companies use a different third-party vendor to handle each element of their corporate purpose programs (giving, matching, volunteering and granting), which can be time-consuming and hard to manage. Plus, working with untrusted partners can put your company’s reputation at risk, making it harder to build a cohesive and inclusive program that your people feel good about participating in.

It's important to be a good steward of your employees’ money and ensure everyone can participate in your social impact programs, regardless of location. Using an all-in-one solution can streamline processes and administration of the following:

- Global programs

- Personal giving and company matching

- Employee volunteering and rewards

- Granting and community investment

How does corporate giving work?

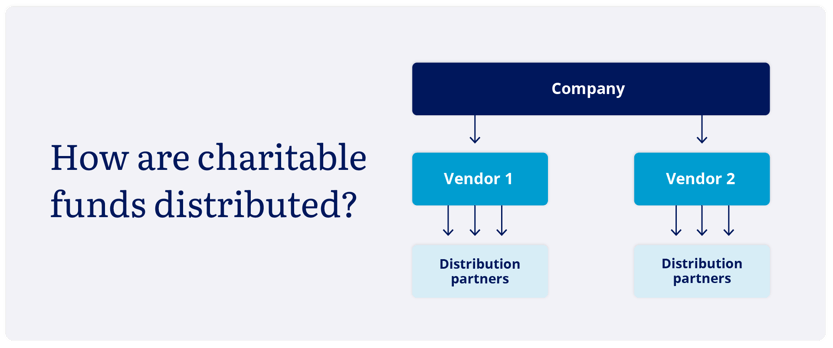

There are lots of ways companies and their people choose to give back to the causes they care about. And companies often use different third-party vendor to manage each of the separate elements of their corporate goodness programs.

How are donated funds distributed?

The third-party vendors that companies use to manage their program(s) often can’t handle the crucial process of sending money to nonprofits. That means they may have to outsource to a patchwork of other distribution partners to get money to the organizations.

Third-party vendors also face challenges with:

- Staying up-to-date on changing regulatory requirements to ensure companies and their people aren't at risk when donating

- Cost-efficient cross-border giving, especially when funds are needed urgently during crisis

- Handling uncashed checks and stale funds

“There is always a cost associated with giving, even if the donation is made directly on the charity’s website. Unfortunately, because of a lack of real information about the true cost of charitable giving across the sector, many companies and donors unintentionally make donations in ways that actually cost charities more, particularly when it comes to lost opportunity related to corporate matching funds.”

– Tom Bognanno, Community Health Charities

So, what’s the bottom line?

In this scenario, even if the vendors says 100% of the funds go to the nonprofit, it’s just not possible. Their outsourced distribution partners can charge 4 to 25% of the donation in payment processing fees.

Once the distribution partners have the funds, they have two options for sending them to nonprofits: check (sent by post) and electronic fund transfer (EFT) or wire payments.

When it comes to sending money electronically, the industry has some catching up to do. Some distribution partners only send checks, and others primarily send checks even when offering EFT.

Checks:

● Are more expensive than EFT.

● Too easily get lost in the mail.

● Can become stale-dated if they’re not deposited in time.

● Can’t be accepted by nonprofits in some countries because they’re obsolete.

EFTs:

● Cut down on manual administration time and costs.

● Don’t get lost in the mail.

● Empower ability to make microdonations.

● Are much faster, often arriving the same day or the next day.

● Are the ONLY way to support many causes across borders.

● Help ensure accuracy.

The costs and processing of checks vs. EFTs

|

|

|

|

|

Nonprofits can lose up to 35% of your donation

No matter how vendors are disbursing, or who they have partnered with to disburse corporate giving funds, the costs are too high — especially when it comes to checks.

Between fees from third-party vendors (and their distribution partners!), the costs to process and record donations, and create and send tax receipts, up to 35% of your donation may never make it to the nonprofit through traditional disbursement processes.

There's a better way to get and send donations

More than 95% of the donations made through Benevity’s platform goes

to the nonprofit!

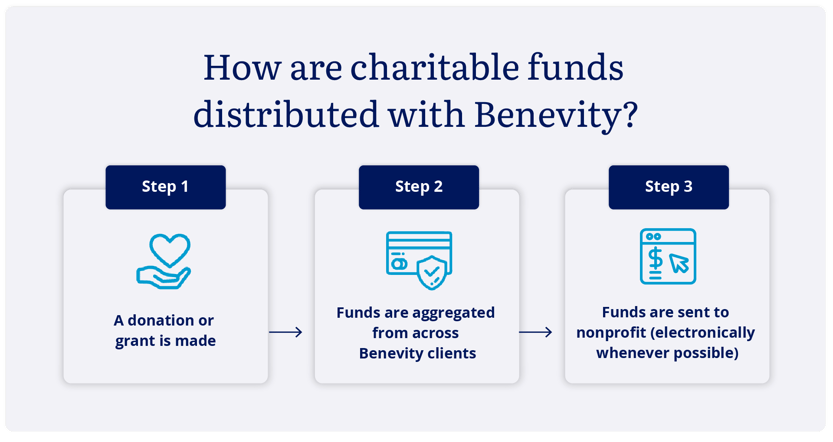

Benevity makes it easier for companies to manage their workplace giving, volunteering and granting programs, and for nonprofits to receive donations. Our all-in-one solution means you only need to work with one software partner to manage all aspects of your corporate purpose program. And our global disbursement process, which includes our network of foundation partners, ensures more than 95% of the funds get to nonprofits — so your donations can make a larger impact.

We aim to send as many funds as possible electronically (over 90%), because that enables nonprofits to quickly put the money to good use. And in times of crisis, we can further expedite the process so the money goes where it is needed urgently.

Benevity also:

- Streamlines the donation and reconciliation process by working with a select network of foundation partners to send aggregate payments from all donations made through our platform to nonprofits worldwide, drastically reducing the number of individual payments they must manage and reconcile, if needed.

- Reduces administration by taking care of reporting, tax receipts and thank-you emails to donors so the nonprofits don’t have to — freeing up more time to focus on their mission.

- Leads the industry in payment efficiency and accuracy (by a large margin!), because we send over 90% of all funds electronically globally. Outside of North America 100% of disbursed funds are sent electronically.

Want to find out more about how our corporate purpose platform works? Schedule a demo with us!